Credit Score - What is it & how does it affect you?

A credit score is a numbering system giving to a person’s risk to a lender, in obtaining credit. Furthermore, there have been some recent changes to how the Equifax credit scoring system works.

The new credit system is called "Comprehensive or Positive Credit reporting" and is different from the old "Negative credit reporting". Consequently, the positive system gives a more detailed analysis of your credit history. As such, lenders share credit history for two years, including credit defaults and court judgements.

What are the Credit Score Numbers?

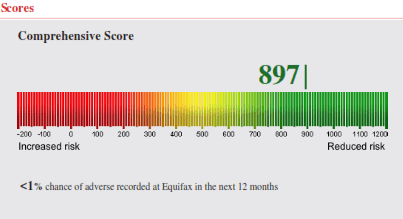

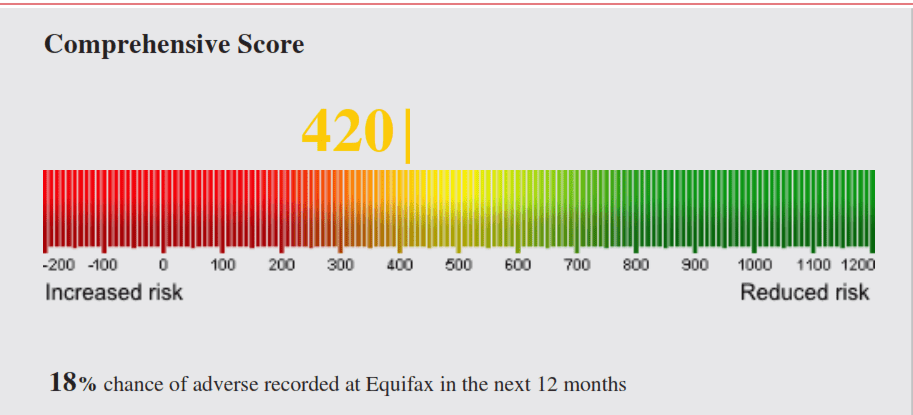

In Australia, your credit score is a number based on your payment history and other factors. As such, see below a credit scoring table from an actual credit report.

To check your credit file, you can obtain directly from Equifax, where you can get your credit information. However, there are a number of credit bureaus that record credit information in Australia. These include, Veda and Equifax, & DNB (Dunn & Bradstreet).

Note that the score number range starts at -200 and continues to +1200. Generally, the numbers in the green area are excellent. Although, other factors affect the score, such as the age of the credit file. Also, time living at an address, the number of applications for credit, and the type of credit enquiry.

How do score numbers affect credit?

Scoring affects virtually any product or service that has credit terms. As such, many credit products can change our credit file. However, the most direct impact you will find is when you lend money.

Consequently, lenders have different acceptable scores for approving loan applications.

- Generally, numbers on the green scale would indicate an excellent score for a home loan application.

- However, a score in the yellow scale would require an explanation or "near-prime" mortgage lending.

- Finally, a score in the red would be a severe credit impairment to a prime loan application.

There is credit reporting when applying for personal and business credit.

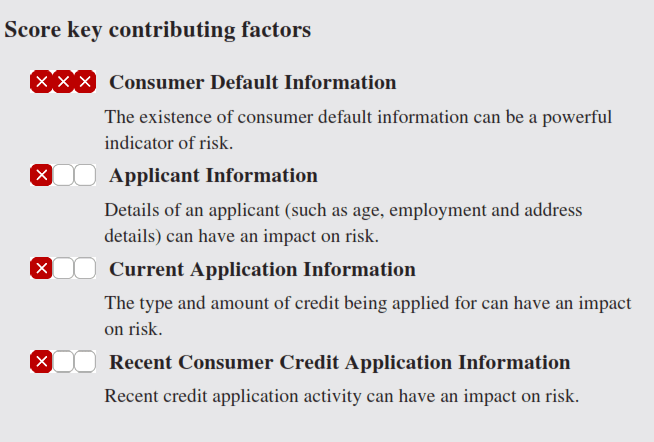

For example, see key factors for credit scoring, as noted in figure 3 below.

Figure 1

Figure 2

Figure 3

Low Credit Score Check

Competitive Interest Rates

Free Credit Report

Let's talk about a loan solution that suits you

Uses of Credit Score

Maintaining a good score is very important in obtaining finance. Particularly, since the introduction of positive credit reporting. Although, there have always been several lenders using some form of the scoring system in their application assessment.

Recently, Veda (now Equifax) started a positive credit reporting model. As such, most lenders now are using the new system over the old negative reporting system. Consequently, as applications move to electronic lodgement and online applications, so to will the reliance on automated credit scoring methods.

If you have found you are having issues with loan applications; this may be a credit issue. However, Loan Saver Network offers a free credit file with all loan assessments. Therefore, contact us via the online enquiry form or call us to discuss your problem.

How is Credit Score Calculated

Your credit score is an automatic calculation obtained using information from loan enquiries and ongoing credit. Also, there is other information used, such as current and past addresses, plus the age of the credit file. Although, the scoring algorithm isn't available; it's not too difficult to understand how your score is determined.

Information that contributes to your Credit Score

- Firstly, your number of credit applications; as credit enquiries and requests are an indication of your need for money. As such, higher application enquiries shows desperation for money and will depress your score.

- Furthermore, credit applications should be limited to no more than 2 in 12 months to maintain your credit score. Therefore, substantial numbers of online credit applications & searches for credit can impact your score. Such as where-ever you authorise access to your credit file for online credit applications.

- Thirdly, the types of credit applications affect your credit file.

- For example, if you apply for finance through a payday lender, this will severely affect your score. Indeed, personal payday enquires can prevent any chance of obtaining traditional funding.

- For this reason, applying for payday finance indicates you have an extremely urgent need for a small amount of money. Consequently, showing you as a high-risk client.

- Although, enquiries for credit applications such as a utility company will have minimal effect on your credit rating.

- Also, some lenders put more reliance on credit scores than others. For example, some car loan lenders wont lend to an application with a score less than 600. Therefore requiring some form of bad credit car loan to purchase a vehicle.

- Finally, multiple changes in addresses - this has an effect on a credit score based on stability. Importantly, As cars are moveable assets, vehicle finance applications require domestic stability.

Negative Score Information

- Repayment History - one of the recent changes in the recording of your repayment history on credit cards and other credit. As such, your credit file records repayments for two years. Therefore, if you are more than 30 days late on a payment, it will be recorded on your credit file.

- Importantly, a credit default has a severe negative effect on your credit score.

- Also, Court judgements or being a director of a company in liquidation or winding-up proceedings, court writs, clear outs.

- Finally, a bankruptcy deletes your credit score and will indicate no rating available. Also, likewise for all sections of the bankruptcy act. Including, part 10 Insolvency (Personal Insolvency Agreement - PIA) and Part 9 Debt Agreement.

Your credit score assists a lender to make financial decisions regarding your loan assessment. More importantly, when you apply for credit with traditional banks they will use scoring as part of their loan assessment. As such, lenders require you to agree to them reviewing your credit file via privacy authority to access your file. Therefore, the privacy agreement will be in the terms and conditions of your credit application.

If you have a low or bad credit score call Loan Saver Network on 1300 796 850. Loan Saver offers free and confidential bad credit home loans and debt consolidation assessments. For your information, Loan Saver Network holds an Australian Credit Licence (388005).