Mortgage Stress: Are you pressured by inflation & increasing interest rates?

August 11, 2023

Why Do I Owe the ATO Money & What to Do About It?

January 4, 2024What are the Benefits of a Debt Consolidation Calculator?

If you're struggling with debt, a debt consolidation calculator may be a valuable tool. However, what are the benefits of a debt consolidation loan calculator? Plus, can they help you compare different loan options to improve your financial situation?

What is a debt consolidation calculator?

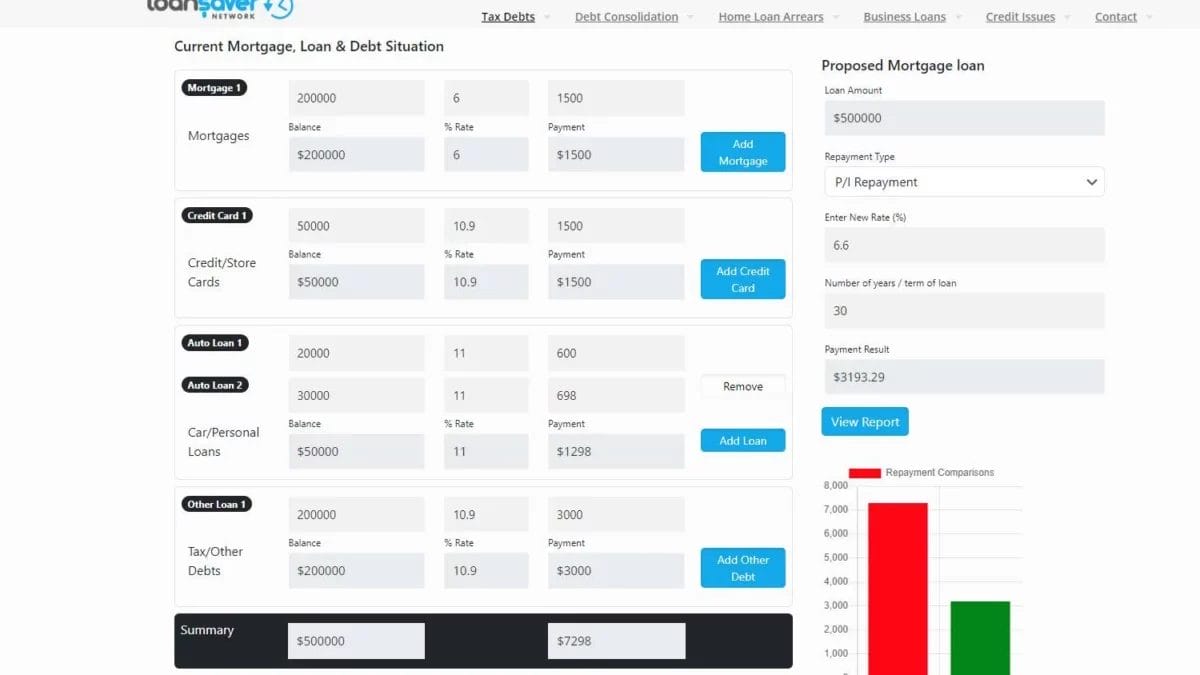

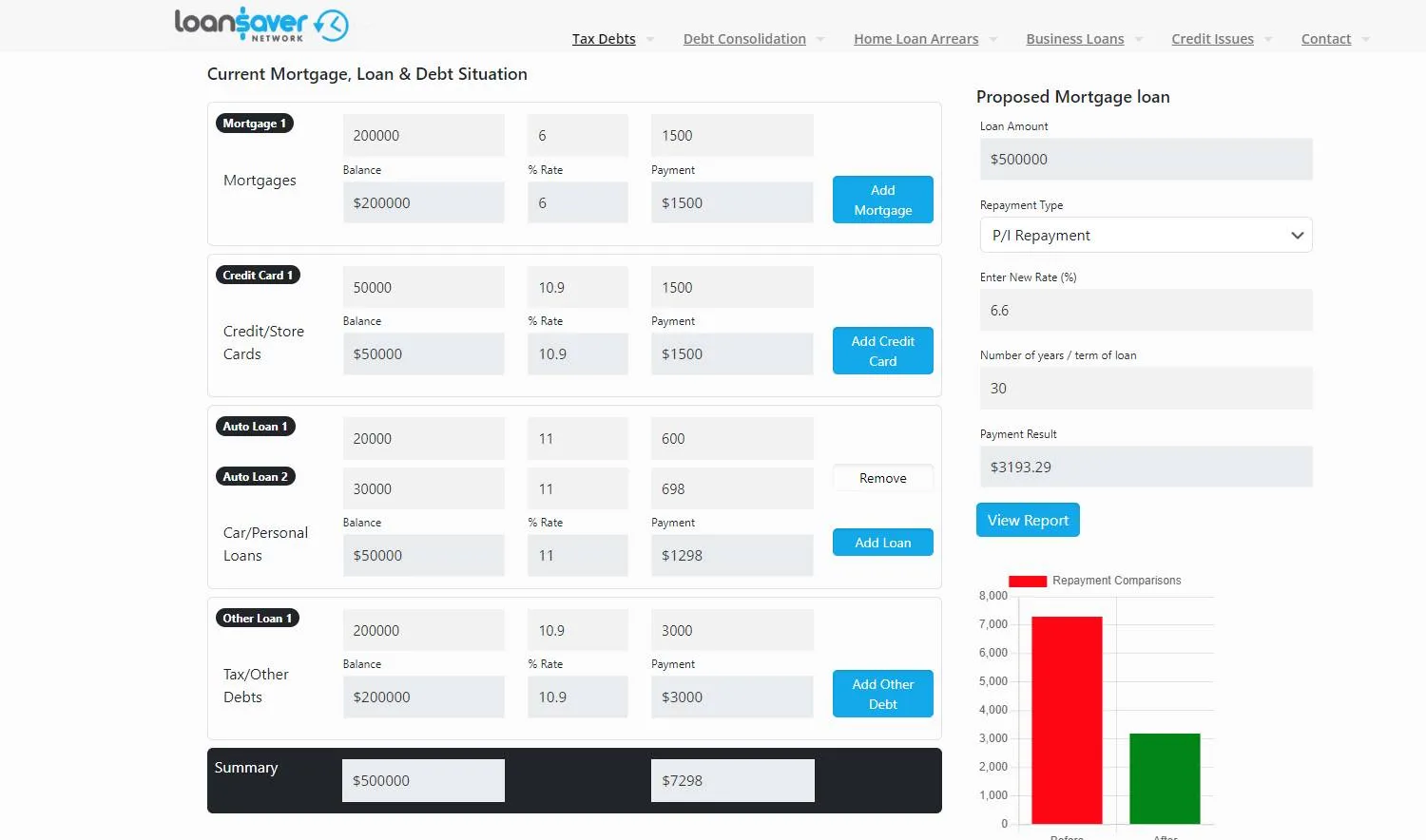

A Debt consolidation calculator is an online tool to help complete calculations. Indeed, the caclulation results helps figure out if your ideas are worth pursueing. Therefore you would calculate how much money you might save when you combine debts into one loan payment. As such, to use a debt consolidation loan calculator, simply enter your various debts. Including:

- Credit card debt.

- Personal loans.

- Car loans.

- Tax debt

- Interest rates.

- Loan repayments.

The calculator will then show you how much you could save each month by consolidating your debt.

However, there may be other options available on the Money smart website can show you other debt options.

How to use a debt consolidation loan calculator?

To use a debt consolidation calculator, follow these steps:

- Firstly, enter all of your debts, interest rates, and the repayments.

- Secondly, add extra loans or debts if required.

- Then choose the loan term you intend to pay. Then input your current remaining loan term as its always better not to extend your term.

- Finally, click "Calculate" and print the mortgage calculator report.

-

Note that all payments are noted as monthly payments.

The calculator will show you your total loan amount, estimated monthly repayment, and how much you could save over the life of the loan.

Benefits of using a mortgage consolidation calculator.

Some of the benefits in using mortgage calculators in your assessment include the following:

- Firstly, compare different loan options: a mortgage calculator can help you compare different debt consolidation loan options from different lenders. This can help you find the best home equity loan for your needs and save money on interest.

- Secondly, a debt consolidation calculator can show you how much you could save in repayments each month. This can help you budget for your debt payments and reach your financial goals faster.

- Thirdly, make an informed decision: A debt consolidation calculator can help you make an informed decision about whether or not debt consolidation is right for you. By comparing different loan offers and seeing how much you could save, you can decide if debt consolidation is the best way to manage your total amount of debt.

- Finally, other options may include refinancing your personal loans or even a balance transfer credit card for a lower interest rate.

Limitations of using an online calculator.

While debt consolidation calculators can be a valuable tool, there are a few limitations to keep in mind:

- Initially, they don't take all factors into account: Debt consolidation loan calculators don't take all factors into account, such as your credit score and debt-to-income ratio. You can qualify for a debt consolidation loan and receive an interest rate offer based on these factors.

- Plus, they can't guarantee savings: Debt consolidation loan calculators can't guarantee you'll save money. Whether or not you save money depends on the terms of your debt consolidation loan and the interest rates on your current debts.

- Also, a major part of a lender assessment is reviewing your credit report. Interest rate pricing depends on your credit score, defaults, and judgments. Consequently, any mortgage calculator cannot give an accurate interest rate.

How to get the most out of using a consolidation calculator?

While debt consolidation loan calculators can be a valuable tool, there are a few limitations to keep in mind:

- First, they don't take all factors into account: Debt consolidation calculators don't take all factors into account, such as your credit score and debt-to-income ratio. These factors can affect your ability to qualify for a debt consolidation loan and the interest rate you're offered.

- Second, they can't guarantee savings: Debt consolidation calculators can't guarantee you'll save money. Whether or not you save money depends on the terms of your debt consolidation loan to pay and the interest rates on your current debts.

If you're struggling with debt, a debt consolidation calculator can be a valuable tool. It can help you compare different loan offers and see how much you could save each month before you apply for a debt consolidation loan. By using a debt consolidation calculator and following the tips above, you can make an informed decision about whether or not debt consolidation is right for you and reach your financial goals faster.