Is Your Debt Consolidation Loan Really a Bankruptcy?

May 20, 2020What other debt solutions are there?

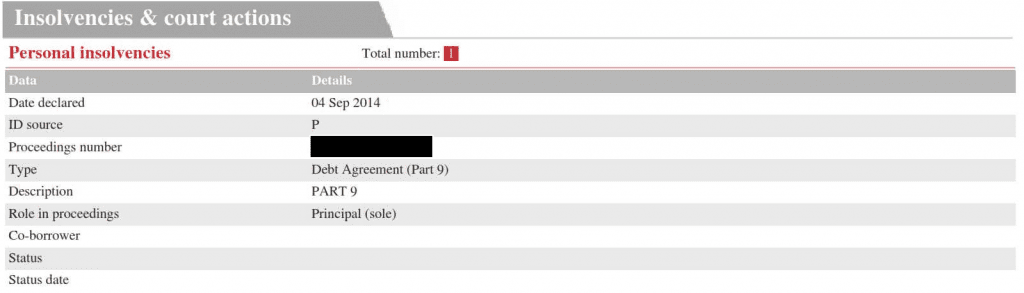

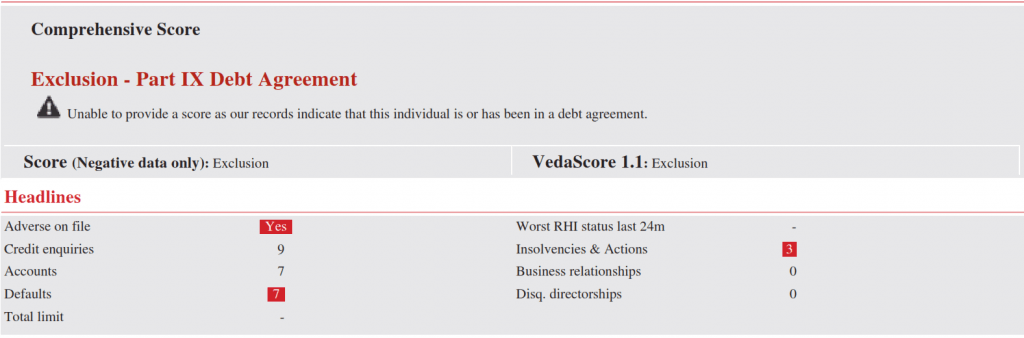

May 20, 2020Various parties can access information about your insolvency, which is kept on a number of databases.

- Firstly, credit reporting agencies record all forms of bankruptcy on your credit file.

- However, the National Personal Insolvency Index (NPII) also holds all forms of bankruptcy. Recorded information on the NPII is held longer than on your credit file.

- Finally, lenders will look at your credit file when you apply for credit. As such, Part 9 may prevent you from getting further finance. Although, not all lenders check for long term insolvencies.

Applying for a Part 9 Debt Agreement is an act of bankruptcy. Another key point is if your creditors reject your agreement, you can apply to the court to make you bankrupt.